Tax loss Carry forward

Non-Biz Profit/Loss Can be Carried Forward: Karnataka High Court

- The issue of companies being able to carry forward profits or losses from ‘’non-business income’’ or from non-business operations has been highlighted by a Karnataka court ruling.

- According to the accounting rules, firms are allowed to carry forward profit and losses in financial statements up to 8 years. This accounting treatment affects the company’s profitability and also the tax outgo.

- The recent Karnataka high court ruling said that if a company while paying taxes or preparing financial statements had categorised a certain amount as ‘’other business income’’ that amount could be used to carry forward profits or losses.

- The tax department objected to a treatment by a steel company at Karnataka high court. The steel company had set off its carry forward business loss with capital gains arising from transfer of a business asset – a piece of land.

- The Karnataka high court ruled in favour of the steel company. The tax laws use the phrase ‘’profits or gains, if any, of business or profession’’ the court observed’’

- Tax experts said that this ruling can go a long way for business in getting a set-off income which could be treated as business income but not taxed under the head profits and gains of a business and profession.

- Many companies will now be able to carry forward profit or loss from non-core operations including selling land or capital market gains.

Source: Economic Times

AGR Dues

AGR Issue Back In SC

- Adjusted gross revenue (AGR) is the usage and licensing fee that telecom operators are charged by the department of TELE communications (DoT). It is divided into spectrum usage and licensing fees, pegged between 3-5% and 8% respectively.

- The main dispute between the DoT and mobile operators is about the definition of AGR includes all revenues (before discounts) from both telecom and non- telecom services. The companies claimed that AGR should comprise just the revenue accrued from core services and not dividend, the interest of sale of any investment or fixed assets.

- As per DoT, the charges are calculated based on all revenues earned by a tele-including non-telecom related sources such as deposit interests and asset sales.

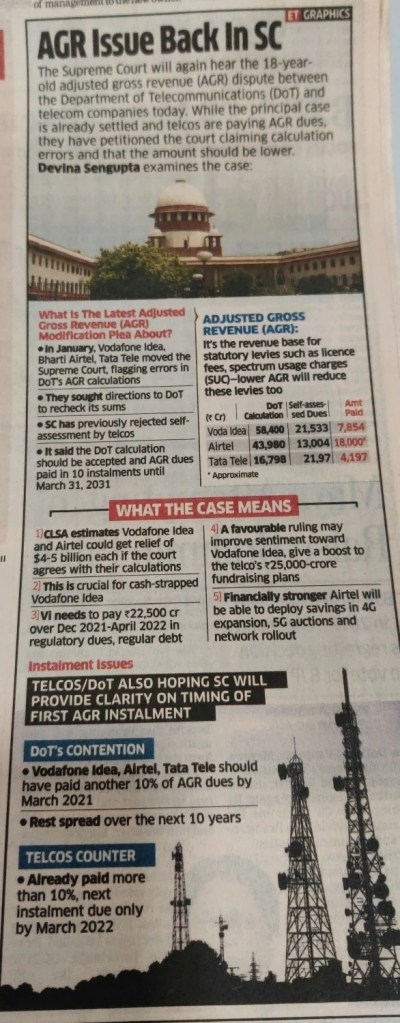

- Telecom companies like Vodafone idea, Bharti airtel and Tata tele moved to supreme court flagging errors in DoT’s AGR calculations. The companies sought directions to DoT to recheck it’s sums. Self-assessment by tele companies was previously rejected by the SC. It said the DoT calculations should be accepted and AGR dues paid in 10 instalments until 31st March 2021.

- According to CLSA estimates, Vodafone idea & Airtel could get $4-5 billion each if court agrees with their calculations which is crucial for cash-strapped Vodafone idea. A favourable ruling may give a boost to the tele companies, 25000 crores fundraising plans. Financially stronger Airtel will be able to deploy savings in 4G expansion, 5G auctions and network rollout.

- Tele companies/ DoT are also hoping SG will provide some clarity on timing of first AGR instalment.

- DoT’s contention is that the telecoms should have paid another 10% AGR dues by March 2021 and the rest paid over the next 10 years and the telecoms counter is that they have already paid more than 10% and next instalment is due only by March 2022.

Source: Economic Times

Textile

Textile Cos Rally as Street Bets on Gains from US-China Tiff

- Shares of textile companies extended their run-up in an otherwise subdued market. Investors bet that the Indian textile industry would be one of the major beneficiaries due to the escalating trade-war between USA and China and from indications of strong demand from the European countries.

- KPR Mill, Siyaram Silk Mills, Welspun India, Trident, Himatsingka Seide, India Count Industries, Vardhman Textiles, Mayur Uniquoters, Arvind Fashions, Raymond and Bombay Dyeing are the few companies spinning big returns in the last month while the Nifty Index has declined 1% in this period.

- Binod Modi, head strategy, Reliance securities said that the Indian textile industry is in the cusp of sharp revival with double digit volume growth in subsequent years in the backdrop pf improving business ranking in ease of doing business in India, China one plus strategy globally, competitive labour cost and improving technology. He also added that India’s textile exports to the USA have increased by more than 45% in 2021 due to the geopolitical tensions between the USA and China.

- To provide a level playing field to exporters and make products globally competitive the government recently extended the rebate of State and Central taxes and Levies (RoSCTL) scheme on garments and made-ups till March 31, 2024.

- Few companies told the analysts that they have been operating at a higher capacity and capacity utilization is expected to sustain at healthy levels in FY2022 and also Yarn realisation would remain strong on account of the ban on Chinese cotton by the US.

- Kaustubh Pawaskar, analyst, Sharekhan, said most textile companies received strong orders from regions such as the US and Europe due to pent up demand for garment apparel and home textile products as retailers are building up the stock with gradual dual opening economies in most of these regions. He also added that the augmentation of capacity with value-added products, key export markets focusing on increasing supply from India and government support policies provide scope for textile companies to post robust growth in the long run.

- Countries like Bangladesh and Vietnam are also vying for a pie of the shift in business from China.

- Biplab Debbarma, analyst, Antique Stock Broking said that availability of raw material in abundance, competitive labour cost and cheap power cost make India one of the strongest contenders to the Chinese dominance in global textiles space.

Source: Economic Times

Banks

Banks Close Lakhs of Current A/C’s, Clients Open Grievance A/C

- As per the Reserve Bank of India’s directive on current accounts ended on July 31, banks have been forced to close lakhs of current accounts inconveniencing small business owners. Banks sent out emails to customers on closing or freezing their current accounts citing RBI rules that don’t allow the opening of such accounts for borrowers who have loans with other banks. RBI introduced the rule in August last year.

- The banks were given 3 months to adhere to the new norms but the delay in implementation forced RBI to extend the deadline till July 31.

- The new rules were implemented to monitor the cash flows efficiently and control siphoning of funds as RBI had observed that despite prevailing guidelines and penal provisions, borrowers were siphoning and diverting funds by opening multiple current accounts with various banks.

- A senior official with a public sector bank said that they have been forced to close thousands of accounts for the entire banking system which would eventually run into lakhs. SBI alone is said to have closed more than 60,000 accounts after sending repeated reminders to customers.

- The intervention of Finance Minister Nirmala Sitharaman was sought by several angry customers on twitter.

- According to the bankers they gave ample time to the customers and sent multiple reminders to the customers since last year but many borrowers did not take this seriously and waited till the last moment to face the fallout.

Source: Economic Times

Lenders Circumventing Current Account Situation

- The banks are cutting a new deal with corporates loosely called the FD-OD deal. It’s a simple arrangement where a company parks some funds as fixed deposits and the bank gives an overdraft to the client. The innocuous transaction is being used as a ploy to overcome the regulation that prohibits a bank from having a current account of a company to which it has given very little to no loans.

- RBI has got a wind of this tactic used by the banks to dodge the rule as OD is a credit facility which helps banks to retain the current accounts which has not gone well with central bank.

Source: Economic Times