Sugar Bomb

Sugar Stocks Rally as Govt Advances Ethanol Blend Target

- From 2025 to 2023 the government advanced the deadline for 20% ethanol blending in petrol.

- The move can divert a sizeable amount of sugarcane to ethanol production and this should essentially bode well for sugar industry as the situation of a supply glut will automatically get addressed and will support pricing discipline in long run.

- The tight supply situation in global market has pushed sugar prices to a four year high.

Insurance Hedging Bad Risk Via Vaccination

Covid-19 Shot Before Cover

Max Life, Tata AIA Make Vaccination Must for Term Life

- Insurance companies such as Max Life and Tata AIA have taken the lead in asking for mandatory vaccine Covid-19 vaccination certificates from the buyers of Term life insurance.

- Other insurers likely to follow the suit. The move seems to be triggered by global insurers such as Munich Re and Swiss Re, the biggest underwriters of risk for domestic insurance companies.

- Non vaccinated deemed as increased mortality rate.

- Mandatory vaccine certificates for term cover help tighten management in anticipation of possible third wave, encourage more people to get inoculated, increase scrutiny on vaccine hesitant policyholders.

Real Estate:

US Home Prices Jump at Fastest Pace in More Than 15 Years

- US home prices have jumped at fastest pace in more than 15 years. Prices jumped nearly at 15% in April from the previous year.

- As a result of the dramatic price gains the home sales have started to slow as more would be buyers are priced out the market.

- All 20 cities that make up the index reported higher year-over-year price gains in April than in previous months.

- Charlotte, Cleveland, Dallas, Denver and Seattle are the five cities which had the largest 12 month price increases on the record dating back 30 years.

Covered Bonds

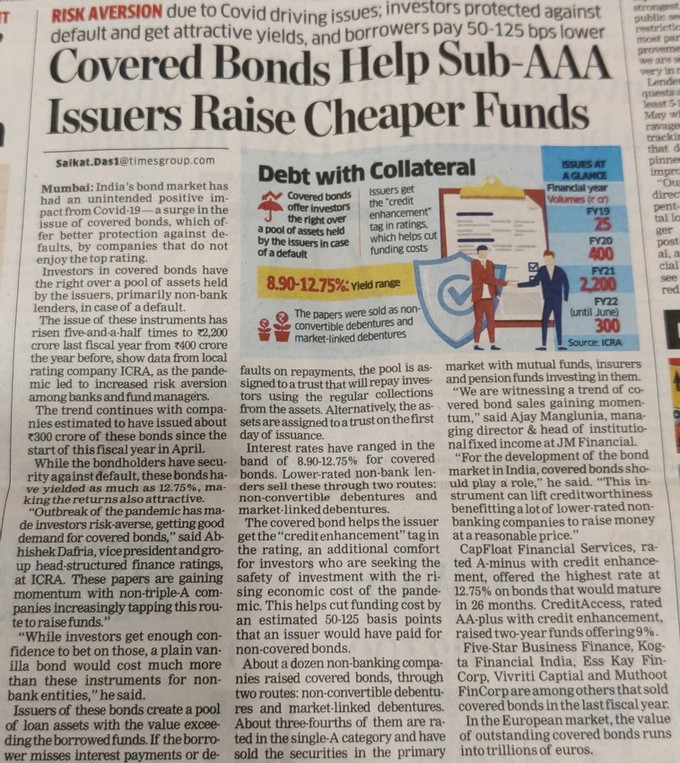

Covered Bonds Help Sub- AAA Issuers Raise Cheaper Funds

- India’s bond market has had an unintended positive impact from Covid-19. A surge in the issue of covered bonds, which offer better protection against defaults, by companies that do not enjoy the top rating.

- While the bondholders have security against default, these bonds have yielded as much as 12.75%, making the returns attractive

- These bonds are gaining momentum with non-triple-A companies increasingly tapping this route to raise funds.

- About a dozen non-banking companies raised bonds, through two routes: non-convertible debentures and market linked debentures.

Fixed Income Rejig for accounting gains

PSU Banks Make the Most of Bond Rally to Rake in Big Profits

- State-run banks to log profits for the first time in five years due to falling yields across the board.

- The banks reported a PBT of about Rs. 45900 crores in FY21 of which more than two-thirds came from bond portfolios.

- The benchmark yield swung between 5.72% and 6.51%, a differential of 79 basis points, encouraging trading.

Commodities

Commodity Traders Bag Billions While Prices Rise for Everyone else

- From oil to copper, the price of every commodity is rising in 2021. The Bloomberg Commodities Spot Index, a measure of 22 raw material prices, is up 78% from the March 2020 low when the pandemic first hit.

- The world is facing a structural inflation shock. There’s a lot of pent up demand and everyone wants everything right now said Dough king.

- The boom is an unwelcome development for policymakers tackling the climate crisis as rising commodities prices will make the shift more expensive.

- China, reliant on raw material imports to feed millions of factories and building sites is so nervous the government has tried to force prices lower, threatening crackdowns on speculators and releasing strategic stockpiles.

Tightening Ahead?

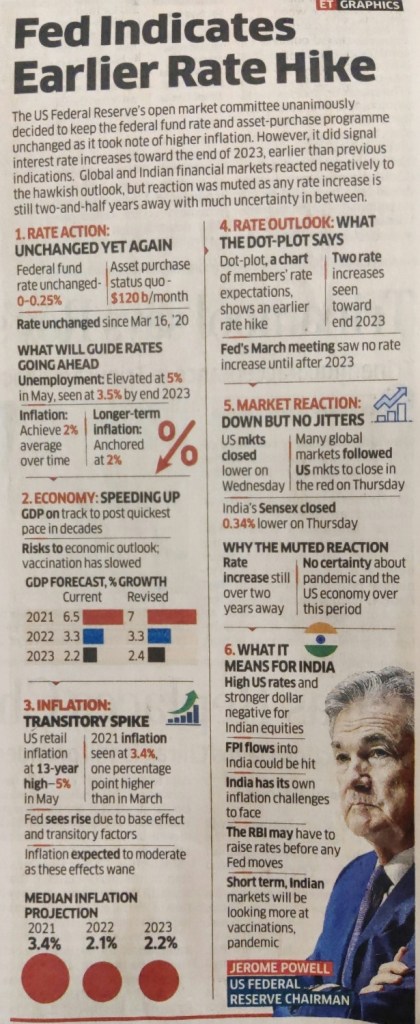

Fed Indicates Earlier Rate Hike

- The US federal reserve’s open market committee unanimously decided to keep the federal fund rate and asset-purchase programme unchanged as it took note of higher inflation. It signalled an interest rate increase towards the end of 2023, earlier than previous predictions.

- Due to the higher inflation rate the unemployment rate is estimated to be elevated from 5% to 3.5%.

- Dot-Plot a chart of members rate expectations, shows a two rate hike towards end of 2023.

Fed’s About to Shift Gears, but This Time it may be Different

- Federal Reserve officials have begun telegraphing an exit from the central bank’s monetary policy. They are increasingly confident that the U.S. economy is recovering fast from the pandemic infused recession.

- By the end of 2023 they will have raised the Fed’s benchmark short-term interest rate at least twice from the net zero level.

- The shift in gears, from easing policy to slowly tightening it, is imminent.

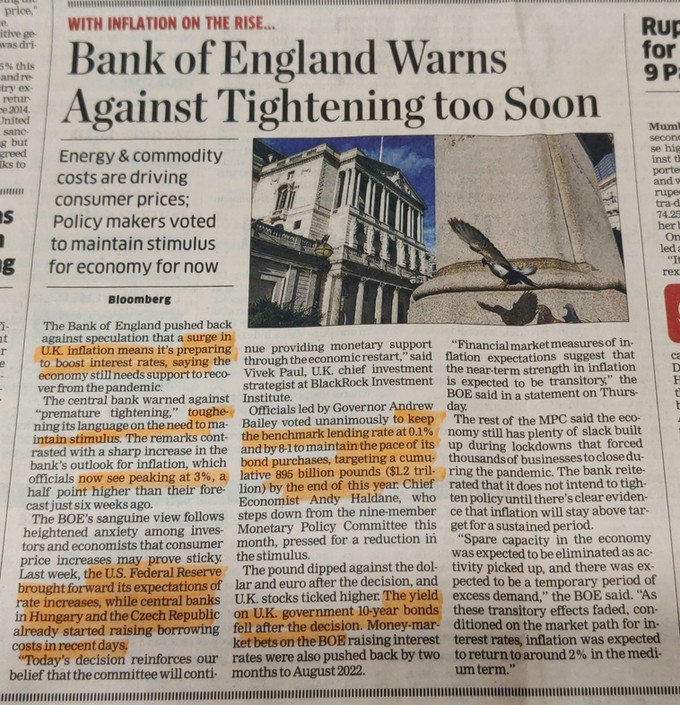

Bank of England Warns Against Tightening too Soon

- The central bank warned against premature tightening.

- The inflation in England is peaking at 3%.

- Hungary and Czech Republic started raising borrowing costs as these expectations came out.

- Officials led by Governor Andrew Bailey voted unanimously to keep the benchmark lending rate at 0.1% and by 8-1 to maintain the pace of its bond purchases.

- The yield on U.K. government 10 year bond went down.

We see rupee devaluing as exports become priority

- Ajay Manglunia, managing director and head of Institutional fixed income at JM Financial said in an interview that India will continue to provide attractive spreads vis-a-vis macros.

- RBI is likely to continue with its support measures till growth is back firmly.

- In the post-covid world, Indian economy is likely to play a larger role as a manufacturing hub and accordingly will keep attracting Foreign Capital.

- Rupee will depreciate in long run as export will become a main priority for India.

- The inflation will be within RBI’s tolerance levels, albeit at the higher end of the scale.